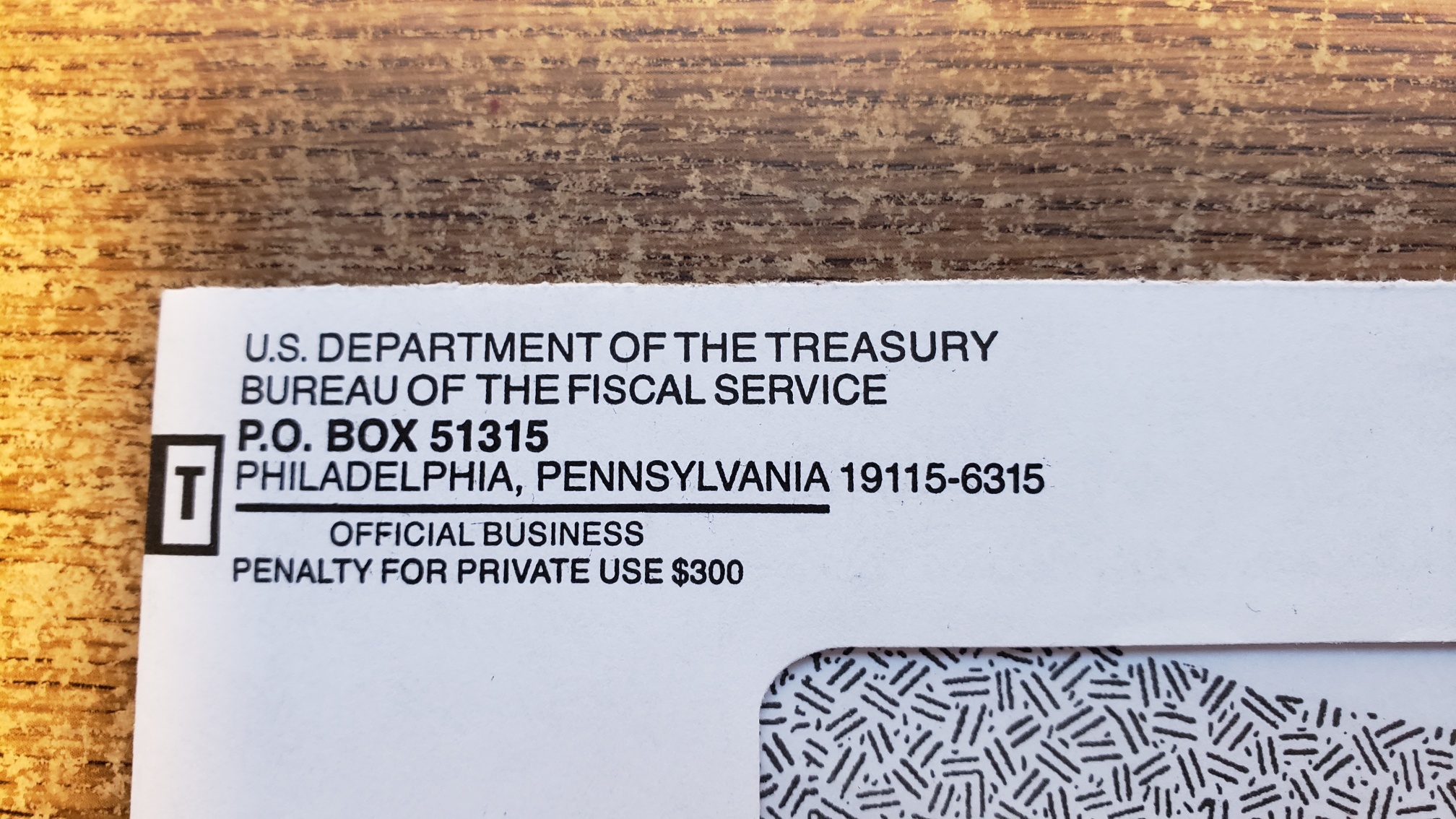

A lot of the mail that finds its way to Brumby Road is junk that gets dropped in the garbage can in the garage without ever entering the house. But not when it arrives looking like this:

Much of our mail is at least a little unwelcome: PG&E bills, jury duty summons, property tax notices, medical insurance bills or doctor bills all produce a sigh of resignation and thoughts of ‘such is life’. But a letter from the IRS when none is expected produces outright terror.

I do our taxes myself using Turbo Tax. I don’t cheat. I report all our income. I juggle RMD’s and 1099 DIV’s and Form 1040 ES’s and even a schedule for farm rental income and expenses. And as I said, I don’t cheat, although the tax code is so complicated that there are plenty of icebergs to sink you. What I think constitutes a ‘necessary and ordinary’ business expense might not mesh with an auditor’s interpretation.

We had a large one-time income event in 2022: some US Savings Bonds we bought in 1992 matured and all the deferred interest had to be reported as taxable income. I make quarterly estimated payments, and I knew I was underpaying for 2022, but there is a ‘safe harbor’ as long as your payments are 100% of last year’s (2021 for me) tax bill. Which I thought I was doing. But when I filed my taxes in February, Turbo Tax told me I owed a penalty for ‘underpayment of estimated taxes’ Oh no, penalties and interest, what have I done? It turned out the penalty was all of $8.00 (not $80, or $800, or $8,000). I was so relieved I decided not to try to chase down what the issue was.

So this letter from the IRS had me more than a little worried. Maybe the $8.00 penalty was miscalculated? Maybe the large payment for tax due that the IRS withdrew from my back account in mid-March wasn’t properly credited or was stolen by some hacker or identity thief? Or maybe it is an audit notice from one of the 80,000 new IRS agents hired by the Biden Administration to go after scofflaw Red State voters. OK, I know I live in a Blue State but east of I-5 the politics change and Linden votes differently than Oakland/San Francisco/Bay Area communities.

When I saw what was inside the letter I almost jumped for joy: the IRS found that I had OVERPAID my estimated taxes by some $240, and that I could expect a refund for that amount in a couple of weeks. It arrived yesterday. No audit, no fraud accusations, no criminal charges, no jail time. I felt like I had won the lottery.

I have no idea how this happened. I looked at our tax return and everything seems correct, but the amount Turbo Tax said I owed was $240 more than the IRS’s tax computation. Perhaps I entered my estimated payments incorrectly. Perhaps Turbo Tax got confused. Perhaps the income tax system in the U.S. is way too complicated. That is probably something Red, Blue, Purple and all other color States could agree about.

That will buy you a few nice meals when you get here in June.

LikeLike

I’m the same way when it comes to taxes. I’m so cautious that I’m sure I pay way more than I need to, but I live in fear of an audit. I never want to live life having to look over my shoulder for the IRS.

LikeLike

Yay!! Always nice to hear good things happing to good people!

Shawn Russell

Setness Tours

2432 W. Benjamin Holt Dr.

Stockton, Ca 95207

209-476-8486

209-986-4107 cell

shawn@setness.com shawn@setness.com

LikeLike