Economics was given the moniker “The Dismal Science” by Scottish essayist and historian Thomas Carlyle. Carlyle was said to have been inspired by T. R. Malthus’ gloomy prediction that population would always grow faster than food, dooming mankind to unending poverty and hardship. The accuracy of this prediction is typical of economic forecasts to this very day.

John Maynard Keynes famous economist and deficit spending advocate, opined that “In the long run we are all dead”. Certainly true, and a cheery thought to consider this holiday season. Feeling a little too good celebrating with loved ones? Keynes can fix that.

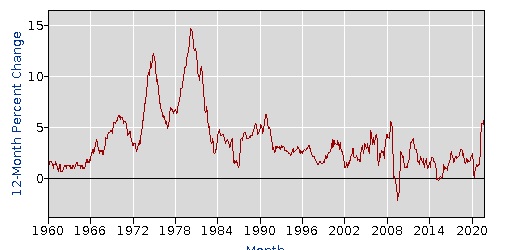

Food shortages don’t seem to be much of a problem, but rising prices, aka “Inflation” are much in the news these days. Here is a graph of the CPI for the last 60 years.

Since July the CPI has been running up about 5 to 7% year over year. This is much higher than the relatively price stable years from 1990 to 2021, but it pales in comparison to the inflation experienced in the US from 1974 until 1984. For a time in 1979 the US had inflation approaching 15%, which is getting close to hyperinflation levels. See Germany post WW1, when workers actually got paid twice a day so they could go out and spend the money before it became even more worthless. People needed wheelbarrows of currency simply to try to purchase bread.

Those were great times, from 1974 to 1980. Gas lines and oil embargoes and price controls. Mortgage rates got to 19% or so. That is not a misprint. Money market funds and short term Treasuries were yielding about 10%, but the purchasing power of your investment was still going backwards.. Unemployment was high, housing prices soared, and a new economic term entered the lexicon, “Stagflation”. The famous Phillips Curve shifted all over the place, and the dismal science was living up to its reputation.

Of course, everyone thinks that the CPI significantly understates the ‘cost of living’. Mostly because right now gasoline and heating oil and natural gas and electricity are all more than 30% higher than last year. Grocery prices are up almost as much. Medicare Part B premiums are going up 14.5% in 2022, and while I haven’t seen the cost of my supplemental policy yet I imagine it will go up at least that much. Somebody has got to pay for all these free COVID tests and vaccines.

Economists have plenty of explanations for why inflation occurs, but none of them work unless there is some underlying increase in the money supply. Here is the accounting identity that becomes a theory with a few assumptions. And you know what they say happens when you assume something…

Central to monetarism is the equation MV = PQ. … The equation suggests that if V is constant and M is increasing, there must be an increase in either Q or P. Accordingly, monetary policymakers can control inflation by allowing the money supply (M) to grow no faster than the desired rate of economic growth

Now what happened in the United States, and indeed in most developed economies, is that when the pandemic hit and businesses and economic activity were shut down, governments ‘created money’ (don’t get me started on that one, we’ll be taking Gold Standard next) to try to stave off a depression. Didn’t work; I’ve been depressed since this thing started and it’s getting worse.

M went up. A lot. Remember those $1500 deposits that showed up in your checking accounts? There was lots of money being magically created and distributed. You could even apply for funeral cost assistance if the victim died from COVID! See my blog article https://freehtt.org/2021/05/05/death-discrimination/

All this created money was going to chase a relatively fixed amount of goods and services. In the short run (not the fatal long run) the supply of goods and services is pretty much fixed. It takes time to adjust production schedules and logistics and deliveries. Assuming Q fixed and V constant, then M goes up and so does P. Presto, inflation!

I have no idea if inflation is going to continue or not. The Federal Reserve has indicated they are going to raise short term interest rates 2 or 3 times next year to try to slow the growth of the money supple and price inflation to the ‘healthy’ level of 2-3%. But if you are going to the gas station or grocery store, brace yourself.

Holiday meals are costing a fortune!! Have you bought a Prime Rib lately??? As my Dad would say, when you get to the checkout stand, you feel the need to look behind you because it feels like you’re getting screwed! Although, we both know, Steve would have used a different word. Merry Christmas!

LikeLike

simply superb writing!!!

Sent from my iPhone

>

LikeLike