President Biden promised that his first Supreme Court nominee would be an African American woman, and at first glance it seems he delivered on that promise. But things are not so simple…

Most people start to really hate mathematics when they encounter Euclidean geometry. This is the first time they come face to face with an axiomatic system. An axiomatic system has to start somewhere, so geometry has some ‘undefined terms’ : point, line and plane.

Legal scholars wrestle with definitions all the time. And they don’t always succeed. Consider what Justice Potter Stewart said in 1964 in a free speech/pornography case that reached the Supreme Court. He tried to explain what is ‘obscene’ by saying “I shall not today attempt further to define the kinds of material I understand to be embraced… but I know it when I see it …”

So like point, line and plane, ‘obscenity’ is an undefined term, at least before our highest court. I wonder what Justice Stewart would think of the kind of stuff that pops up in your browser when ‘safe search’ is disabled? This isn’t 1964!

Our next Supreme Court Justice has another undefined legal term for us to consider:

SEN. MARSHA BLACKBURN: Can you provide a definition for the word woman?

JUDGE JACKSON: Can I provide a definition?

BLACKBURN: Yeah.

JACKSON: I can’t.

BLACKBURN: You can’t?

JACKSON: Not in this context. I’m not a biologist.

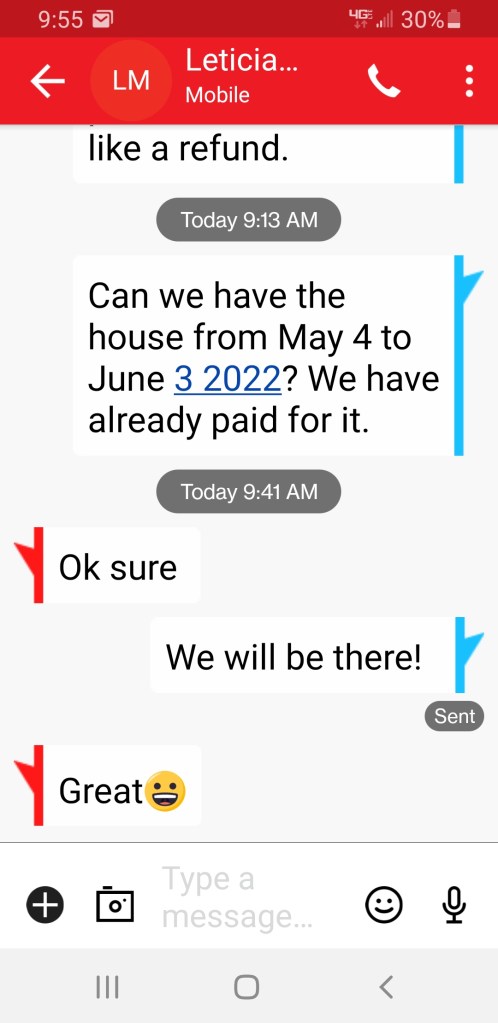

I’m not a biologist either, but I never knew there was any confusion over the subject. Like Justice Stewart, I know one when I see one. But of course the world view from Brumby Road is way too narrow. For example, the NCAA thinks this is a woman:

No wonder Justice Jackson decided to pass on a definition. Perhaps she could have followed Justice Stewart’s precedent and resorted to the ‘know it when I see it’ method.

So is Justice Jackson a woman? President Biden promised us a woman nominee, but if the term is in dispute how do we know she is a ‘she’?

Walter Scott took a crack at the issue:

O woman! in our hours of ease Uncertain, coy, and hard to please… When pain and anguish wring the brow, A ministering angel thou!

So if she is a she, you can count on her interrupting you for some ‘honey do’ while you are watching an NFL game and sipping a martini, but if you get sick and just want to be left alone to suffer in peace she will hover offering hot soup or a cool compress. Uncertain indeed!

We could look to Shakespeare for some input: “Why makes thou it so strange? She is a woman, therefore may be wooed; She is a woman, therefore may be won“

I guess that didn’t help much either. All this wooing and winning stuff kind of makes it look like men are up to no good and only after women for one thing. And we will do almost anything for that ‘one thing’. Example: guess who goes up on the roof to clean the gutters? Or crawls under the house to put out rodent bait? Remember we live in the country where the critters are a problem. The bait works, the rats and mice die and the dried bodies litter the dirt floor of the crawl space. One of my favorite home maintenance tasks.

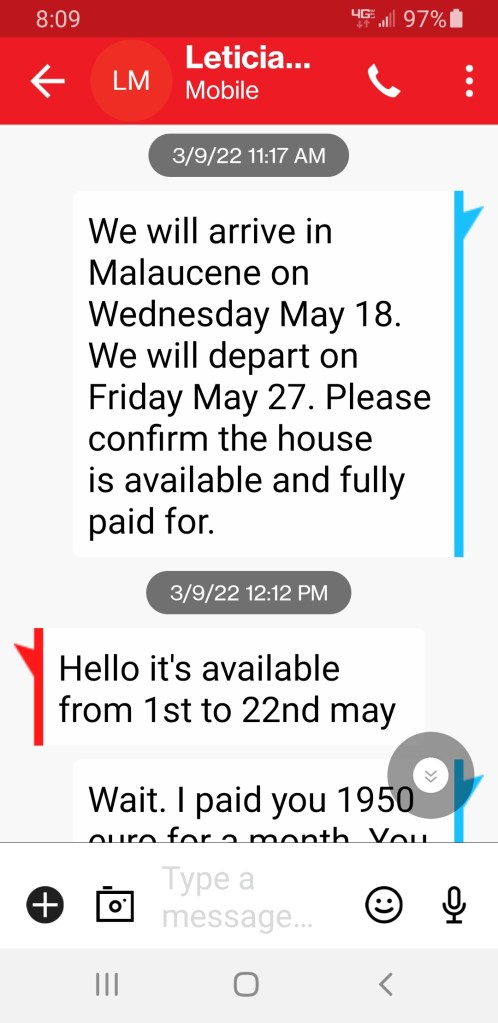

Since ‘woman’ is going to be considered undefined, I need to consider whether Stoker is one, or if I have simply been deceiving myself for the last 40 years. A close physical inspection reveals the predicted differences between me and she (pronoun assumed), but I guess the real issue is whether she (?) identifies as a woman. If she doesn’t, next year I’ll leave the crawl space excursion to (non binary pronoun).