Some readers may wonder why I haven’t written about the tariffs and the stock market and the future of the world economy. The reason is that everyone has an opinion, and the kinder and gentler me is trying to avoid conflict. I am pretty much against anything that stifles free trade unless those measures enhance national security or are a response to other countries using unfair trade practices to take advantage of us.

So I don’t know if the actions by the Trump Administration are going to be positive or negative. If they lead to a retaliatory trade war and produce a recession, or even worse, a global military conflict, they will prove to be a horrible mistake. If they lead to serious negotiations by nations to create free and fair trade agreements and economic cooperation, they will be a boon. I don’t know which. Lots of pundits, and some of my friends, seem quite sure that they know the answer already.

Here is one view of the objective:

“At the end of the day, I hope it’s agreed that both Europe and the United States should move ideally, in my view, to a zero-tariff situation, effectively creating a free trade zone between Europe and North America,” Musk said.

That would be good, and I hope he is right.

Now on to the stock market. When I look at our personal financial situation, I follow a couple of self imposed rules. I keep our stock market allocation between 60 and 70% of our assets. And those stock investments are not going to be needed for at least 5 years. No forced selling to make RMD’s or pay for a deck replacement (which is almo$t done).

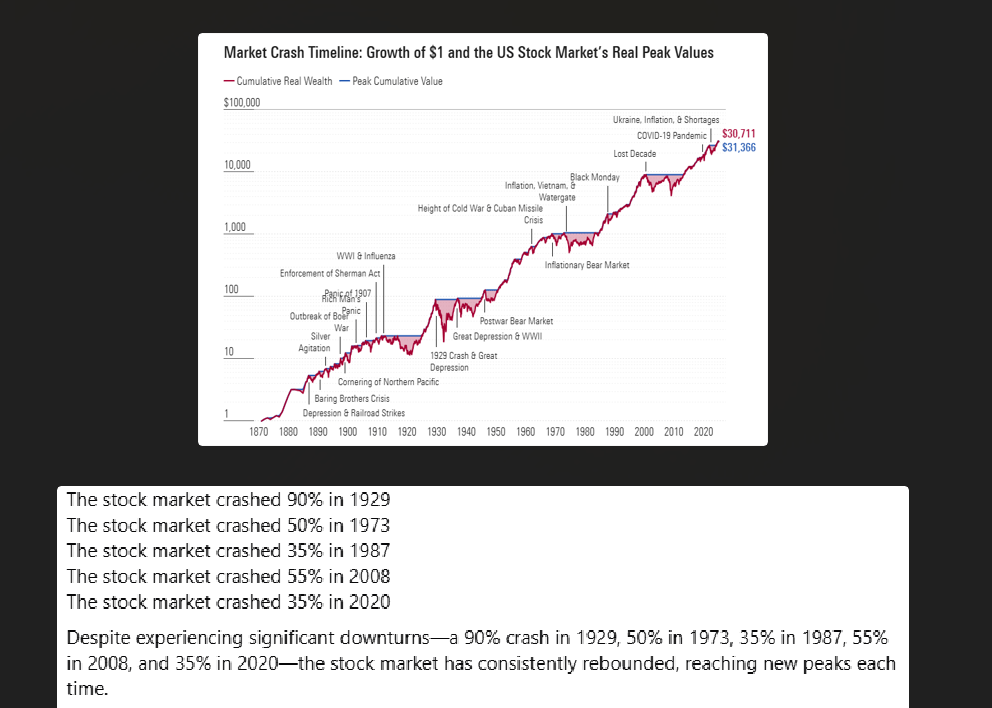

I also do a spreadsheet (surprise!) and look at our asset allocation and total net worth every weekend. I built in some hypothetical calculations of what a 20% drop, and a 40% bear market would do to that total. So I have seen on paper what is happening now, and while I would rather the stock market stay high I am willing to accept the risk of major short term declines. Because those declines happen. The reasons are always different: Financial crisis, dot com bubble bursting, Covid, rampant inflation, a mega volcano in Montana, take your pick. This time it is global uncertainty of the future of trade, supply chains and geopolitical turmoil.

Climbing a wall of worry…the scale is logarithmic, so the slope represents the rate of change in market value

There is over 100 years of stock market history, with many examples of these crashes. Everything looks bad and everyone is sure that the end is near and the apocalypse is upon us. And eventually the market moved to new highs and resumed its long term trend of producing real returns (adjusted for inflation) of around 7.5% per annum. To get that return you have to accept volatility. You don’t have to like it, and if it causes you anxiety and loss of sleep, then better to stick with CD’s. You might beat inflation by 1 or 2%.

Someone said that the 4 most dangerous words in English are “It’s different this time“. Maybe it is, and we are never going to see new market highs and we are on the verge of economic and societal collapse. If you think so then sell stocks and buy guns and gold and water purifiers and emergency food rations. Or heed the magnificent voice of John Houseman when he did Smith Barney commercials back in the 1980’s: “Is the world going to end tomorrow? Probably not.”